WEEKLY MARKET OUTLOOK FOR APR 02 THRU APR 06, 2018

In our previous Weekly note, we had mentioned

about Markets modestly breaching the 27-month long upward rising channel.

Though the lead oscillators were pointing towards being oversold, the level of

10040 remained important all through the previous week.

In the week that had just 3-trading sessions,

the Markets ended on a positive note. The benchmark Index, NIFTY50, ended the

week with net gains of 115.65 points or 1.16% on weekly basis. One of the most

important factors to take note of is that the NIFTY has managed to defend and

crawl back above the critical 10040-mark and therefore the 24-month long upward

rising channel remains intact.

As we approach the coming week, we expect a

positive start to the week and we expect the NIFTY to open and move past

200-Day Moving Average which stands at 10180. Going ahead all through the

coming week, it would be crucial to see if the NIFTY manages to end above

200-DMA.

The Relative Strength Index – RSI on the

Weekly Chart is 45.0478 and it remains neutral showing no divergence against

the price. The Weekly MACD is bearish and it trades below its signal line. No

major pattern was observed on Candles.

While having a look at pattern analysis,

NIFTY has defended and has managed to crawl back above the 10040-mark. This

level was crucial and with this level being defended as of now, the 27-month long

upward rising channel remains intact.

Next week’s strongly opening is nearly

ensured by the global markets which have ended on the strong note. However, it

may be extremely important to see that despite a very likely strong start which

will see NIFTY above the 200-DMA mark in all likelihood, the sustenance above

this level and closing above this level by NIFTY will be important. Also, the

NIFTY remains oversold on Stochastic on Weekly Charts and overall we see the

downsides being very limited. In any case, defending 10040-mark will be crucial

not only in next week but in coming days as well. Overall, we expect positive

undertone to dominate and we advice maintaining positive outlook through the

week ahead.

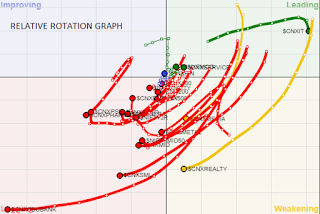

A study of Relative

Rotation Graphs – RRG this week though majority of the sectors are still seen

mildly losing relative momentum and ratio, many key sectors are seen improving

their relative momentum against the Markets and are attempting for major

stability. The coming week will still see relative outperformance from

Services, Financial Services, FMCG and IT pack. Other key sectors like INFRA,

AUTO, Midcap 50, NIFTY NEXT 50 and

ENERGY are seen improving their relative momentum. Therefore, these packs may

see select out-performance by their components. Apart from this, we do not

expect any major moves on Weekly basis from PHARMA, PSU BANKS, BANKNIFTY, and

Small Cap universe.

Important Note: RRG™ charts show you the relative strength and momentum for a group

of stocks. In the above Chart, they show relative performance as against NIFTY

Index and should not be used directly as buy or sell signals.

(Milan

Vaishnav, CMT, MSTA is Consultant Technical Analyst at Gemstone Equity Research

& Advisory Services, Vadodara. He can be reached at milan.vaishnav@equityresearch.asia)

Milan

Vaishnav, CMT, MSTA

Technical Analyst

(Research Analyst, SEBI Reg. No. INH000003341)

Technical Analyst

(Research Analyst, SEBI Reg. No. INH000003341)

Member:

CMT Association (Formerly known as Market Technicians Association, (MTA), USA

Canadian Society of Technical Analysts, (CSTA), CANADA

Society of Technical Analysts (STA), UK

www.EquityResearch.asia

http://milan-vaishnav.blogspot.com

+91- 70164-32277 / +91-98250-16331

milan.vaishnav@equityresearch.asia

milanvaishnav@yahoo.com

CMT Association (Formerly known as Market Technicians Association, (MTA), USA

Canadian Society of Technical Analysts, (CSTA), CANADA

Society of Technical Analysts (STA), UK

www.EquityResearch.asia

http://milan-vaishnav.blogspot.com

+91- 70164-32277 / +91-98250-16331

milan.vaishnav@equityresearch.asia

milanvaishnav@yahoo.com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.