The NIFTY ended the previous week with a modest gain of

40.20 points or 0.50% thanks to the decent sustained recovers that we saw in

the Friday’s session. The Markets are indicating continuance of technical

pullback on week-on-week bases which began in the previous session. The bias

remains towards continuation of pullback but with some caveats. The NIFTY still

rules below 200-DMA on Daily Charts, outside the lower band of Bollinger Band

on the Weekly Charts and also below some critical resistance levels on the Weekly

Charts. However, due to all this some consolidation in a broad range cannot be ruled out but overall

the NIFTY is likely to show resilience to any serious downsides in coming week and

this keeps the bias positive.

For coming Week, the levels of 8168 and 8245 will remain immediate

resistance levels to watch out for. The supports will exist at 7916 7850

levels.

The RSI—Relative Strength Index on the Weekly Chart is 40.8659 and

this remains neutral as it shows no bullish or bearish divergence or any

failure swings. The Weekly MACD still continues to remain bearish as it trades

below its signal line. On Candles, a Hammer occurred. Hammers must appear

after a significant decline or when prices are oversold (which appears to be

the case with * NIFTY 50) to be valid.

When this occurs, it usually indicates the formation of a support level

and is thus considered a bullish pattern. This pattern is similar to Hanging

Man pattern but since occurred during a downtrend, it is called a Bullish

Hammer. Such pattern also has a long lower shadow.

On the derivative front, the NIFTY has began the

December series while shedding over 8.67 lakh shares or 5.78% in Open Interest.

This signifies heavy short covering in Friday’s session. It would be critical

to see if see this being replaced with fresh longs and purchases.

Coming to pattern analysis, the NIFTY have retraced

nearly 900-odd points after it formed a Double Top formation near 8968 levels

and resisted to it. This week, after the retracement of nearly 900-odd points,

it has shown a mild uptick and some indication that a potential bottom has been

formed near 7916-7950 zones. Currently it trades outside the lower band of the

Bollinger Band and with RSI still ruling comfortably above 30, it would be

critical for the NIFTY to crawl back inside the band to avoid any fresh

weakness from creeping in. Further, the zones of 8140-8165 will be critical to

watch out for. NIFTY will have to move past these zones and trade above this to

remain afloat and try and confirm the potential bottom formation.

Overall, in coming week, though we maintain a positive

bias towards pullback, we do not rule out consolidation happing at higher

levels. This will induce volatility in the sessions and also see some intermittent

selling bouts from higher levels. With the current lows of 7916 acting as base,

we will see the NIFTY oscillating in a broad range while maintaining positive

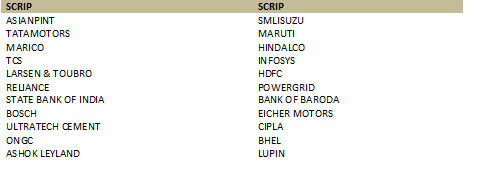

bias. We will see sector rotation also taking pace and will see quality stocks distinctively

out-performing the general Markets. We maintain our view of refraining from

shorts and use all intermittent downsides to accumulate select stocks.

A study of Relative Rotation Graphs – RRG suggest that IT

stocks will continue to improve their performance. During last two Weekly

readings we had mentioned that IT Stocks will show resilience, form base and

improve. This precisely has happened.

This coming week as well, we will continue to see IT and PHARMA stocks continuing

to improve their relative performance. Also, PSU Banks, ENERGY, CNX MID50 and

METAL will out-perform NIFTY on relative basis. Some continued weakening will

be observed in NIFTYJR, BANKNIFTY, FINANIALS, and AUTO which are expected to

struggle to find feet. Some improvement in INFRA stocks can also be expected in

coming week.

Important Note: RRG™ charts show you the relative strength and

momentum for a group of stocks. In the above Chart, they show relative

performance as against NIFTY Index and should not be used directly as buy or

sell signals.

(Milan Vaishnav, CMT, is

Consultant Technical Analyst at Gemstone Equity Research & Advisory

Services, Vadodara. He can be reached at milan.vaishnav@equityresearch.asia)

Milan Vaishnav, CMT

Technical Analyst

(Research Analyst, SEBI Reg.

No. INH000003341)

Member:

Market Technicians Association, (MTA), USA

Canadian Society of Technical Analysts, (CSTA), CANADA

Association of Technical Market Analysts, (ATMA), INDIA

http://milan-vaishnav.blogspot.com

+91-98250-16331