Indian Equities formed a low of 6985 immediate in February

end and since then it began a upward move. It went on to rally for nearly

2000-odd points while it formed an intermediate peak on Daily Chart, a Double

Top on Weekly Chart simultaneously around 8968 levels. It halted the up move

and entered into intermediate downtrend in form of a falling channel,

subsequently breaching that channel to form the lows of 7916, retracing nearly

50% of the referred up move. During this time, we digested Brexit, Donald Trump

victory, Demonetization and its feared impact on slowdown in coming quarters.

Let us now examine the Fixed Income Asset and its

correlation with Equities. The above

is a 10-YR US TREASURY NOTES CONTINOUS (CBT) Chart. If one sees, during

the same time in July, along with Equities, the Bond price too made its top

around USD133-USD134 range and transformed into a falling Channel.

A Fixed Income Analyst would have foreseen the sharp decline in Equities that we witnessed, especially over last fortnight. The ferocity of the fall in Equities to do with the above Chart as well. If we examine the above Chart, The US 10-YR Bond prices reported a “Death Cross” wherein its 50-DMA reported a negative crossover over 200-DMA. This was sometime beginning of November. This is a technically bearish sign indicating that an issue will have bearish implication going ahead. We saw the Bond prices, which were comfortably in a falling channel at that point of time, came to a sharp decline, gave a downward breakout from the falling channel, went beyond its measuring implications and touched a low of USD 126.06.

A Fixed Income Analyst would have foreseen the sharp decline in Equities that we witnessed, especially over last fortnight. The ferocity of the fall in Equities to do with the above Chart as well. If we examine the above Chart, The US 10-YR Bond prices reported a “Death Cross” wherein its 50-DMA reported a negative crossover over 200-DMA. This was sometime beginning of November. This is a technically bearish sign indicating that an issue will have bearish implication going ahead. We saw the Bond prices, which were comfortably in a falling channel at that point of time, came to a sharp decline, gave a downward breakout from the falling channel, went beyond its measuring implications and touched a low of USD 126.06.

We know that Bond Prices and Equities have direct

correlation. Similarly, Yields and Equities have a negative correlation. The

fall in Bond prices caused the Yields to move up sharply as indicated in the

below Chart.

CURRENT VIEW

We believe, at present levels, the Equities may be well

within its range of finding a bottom for itself in the near term. Let us

examine few points that support this view, though potentially.

The Bond Prices, which trade “oversold” on both Daily and Weekly Charts, also trade near its multiyear support levels of 125 and 122. If we examine yields, it does have some room left on upside. This may be filled up by the Bonds which may still see minor pressure in the range of 122-125 which are its multiyear supports. However, they are expected to stabilize in the referred zone.

The Bond Prices, which trade “oversold” on both Daily and Weekly Charts, also trade near its multiyear support levels of 125 and 122. If we examine yields, it does have some room left on upside. This may be filled up by the Bonds which may still see minor pressure in the range of 122-125 which are its multiyear supports. However, they are expected to stabilize in the referred zone.

By the time this happen, we are likely to see some volatile

ranged movements in the Equities. It is most

likely scenario, the Equities may continue to witness volatile sell-offs

from higher levels, but it is likely to remain in a broad range and current

lows are less likely to be broken and is likely to have very limited downsides

beyond that. During these broad movements, we are likely to witness some

potential signs of Accumulation as well.

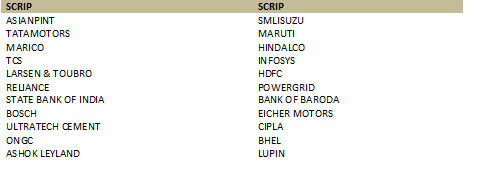

Based on Study of Long

Term Charts, we have short listed few stocks, both Large and MidCap which

Investors should start “Accumulating” at current and each lower levels with a

long term investment

Disclosure pursuant to Clause 19 of SEBI

(Research Analysts) Regulations 2014: Analyst, Family Members or his Associates

holds no financial interest below 1% or higher 1% and has not received any

compensation from the Companies discussed.

Milan Vaishnav,

CMT

Technical Analyst

Technical Analyst

(Research Analyst, SEBI Reg.

No. INH000003341)

Member: Market Technicians Association, (MTA), USA

Member: Association of Technical Market Analysts, (ATMA), INDIA

www.EquityResearch.asia

http://milan-vaishnav.blogspot.com

+91-98250-16331

milan.vaishnav@equityresearch.asia

milanvaishnav@yahoo.com

Member: Market Technicians Association, (MTA), USA

Member: Association of Technical Market Analysts, (ATMA), INDIA

www.EquityResearch.asia

http://milan-vaishnav.blogspot.com

+91-98250-16331

milan.vaishnav@equityresearch.asia

milanvaishnav@yahoo.com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.