MARKET OUTLOOK FOR WEDNESDAY, JULY 12, 2017

In our previous note, we had cautioned about not getting

carried away by the Monday’s up move as the NIFTY moved up more because of

short covering than anything else. The signs of fatigue remained evident in

Tuesday’s session as the Markets pared most of its gains after marking fresh

life time highs. The benchmark NIFTY50 ended with minor gains of 15 points or

0.15%. We expect a quiet start to the Markets and see the Markets remaining in

a capped range. Some shorts were seen added and we expect some consolidation to

return to the Markets.

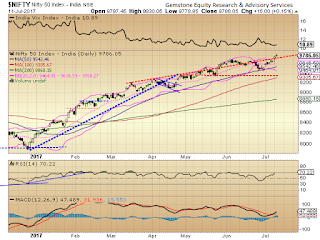

The levels of 9800 and 9830 will act as resistance to the up

move. The supports come in much lower at 9720 and 9685 zones.

The Relative Strength Index – RSI on the Daily Chart is

70.2157 and it has marked a fresh lifetime high which is bullish. However, this

trades mildly overbought. The Daily MACD stays bullish while trading above its

signal line.

The pattern analysis shows Market successfully moving past

the rising trend line drawn from 9200 levels. In event of any consolidation,

this trend line is once again expected to act as support.

Overall, with the underlying current remaining intact, we

expect the Markets to consolidate. With any runaway rise that it may see, the

Markets will remain equally vulnerable to profit taking bouts at higher levels.

We recommend remaining extremely stock specific and preserve more cash while

protecting profits at higher levels.

Milan Vaishnav, CMT

Technical Analyst

(Research Analyst, SEBI Reg. No. INH000003341)

Member:

Market Technicians Association, (MTA), USA

Canadian Society of Technical Analysts, (CSTA), CANADA

+91-98250-16331

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.