MARKET REPORT September

08, 2014

The Markets saw a robust session today as it opened strong

and ended ever stronger after a rally. The Markets saw a nearly gap up and

stronger than expected opening today. After opening on a positive note the

Markets successfully maintained those gains in the first half of the session.

These gains got fortified more in the second half. The Markets, after spending

a sideways first half saw some more strength coming in the second part of the

session. It perked up further and went on to form the day’s high of 8180.20

towards the end of the session. These levels were maintained as well and the

Markets ended the day at 8173.90, posting a robust gain of 87.05 points or

1.08% while forming a higher top and higher bottom on the Daily High Low

Charts.

MARKET TREND FOR TUESDAY, SEPTEMBER 09, 2014

Since the Markets have ended the previous session near the

high point of the day, technically speaking, the Markets are expected see a

quiet opening but trade positive in the initial trade. Though the Markets may

continue with its up move, it should be noted that the Markets trade in “overbought”

territory and also in divergence with the reading given by the F&O figures

over last two days.

The Markets trade in uncharted territory. The resistance can

be expected at 8180 and 8215 levels. The supports come in much lower at 8110

and 8060 levels.

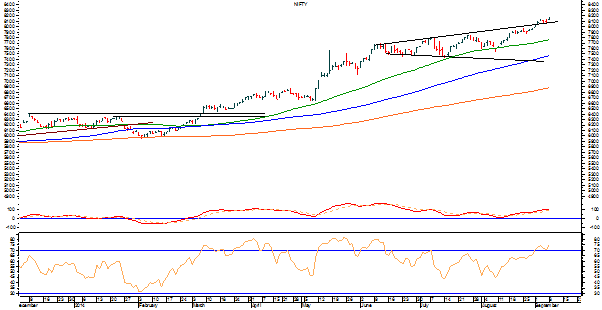

The RSI—Relative Strength Index on the Daily Chart is

75.0847 and it has reached the highest value in last 14-days and this is

bullish. Though it does not show any bullish or bearish divergence, it trades

in “overbought” zone. The Daily MACD trades above its signal line.

On the derivative front, NIFTY September futures have added

over 5.04 lakh shares or 3.29% in Open Interest. This shows that there has been

fresh addition of long positions with the rise in NIFTY. However, the previous

two sessions had shown significant decline in the Open Positions.

Going back to pattern analysis, the Markets have attempted

to break out of the rising trend line. In normal circumstances this translates

into a fresh buy signal but at the same it needs to be taken note of that the

Markets trade quite in “overbought” territory. This makes the Markets

vulnerable to pressure from higher levels, or at least a throw back.

All and all, though the Markets have attempted a fresh

breakout, we should a great word of caution. It is strongly advised to not to

resort to fresh buying until profits are protected in current positions. As a

matter of fact, even the defensive sectoral indices trade in “overbought”

territory and this makes the Markets vulnerable to throwbacks, if not a

correction. Overall, highly cautious outlook is advised.

Milan Vaishnav,

Consulting Technical Analyst,

+91-98250-16331

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.