MARKET OUTLOOK FOR TUESDAY, NOVEMBER 15, 2016

The NIFTY ended the session on Friday with a deep cut and

gave back nearly a third of its prior two day’s recover, it still showed

continued negative ending on closing basis. Today, we can expect some stability

to return to the Markets. Opening is expected to be quiet and though we may see

intraday volatility, the downsides to the remains limited any dips will remain

open to improvement as we go ahead in the session. The levels of 8460 will

remain important pattern resistance for the Markets to watch for.

For today, the levels of 8375 and 8460 will act as immediate

resistance levels for the Markets. The supports come in at 8275 and 8240

levels.

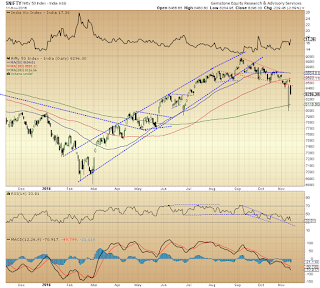

The RSI—Relative Strength Index on the Daily Chart is 33.5323

and it does not show any failure swing. The NIFTY has set a fresh 14-period low

on Closing basis but RSI has not and this has formed a Bullish Divergence on

the Daily Charts. The Daily MACD stays remains bearish as it trades below its

signal line. On the Candles, a formation akin to abandoned baby has

formed. However, this would be less effective and damaging as it has not

occurred after a rally and has occurred during a downtrend.

On the derivative front, the NIFTY November future have

added over 4.93 lakh shares or 2.90% in Open Interest. This signifies that

fresh shorts have been added as the decline has come along with addition in

Open Interest.

Coming to pattern analysis, it is evident that the NIFTY has

given a downward breakout from the falling channel formed since 8968 levels.

The return line (Support line or the Lower Line) of that channel which was

acting as support will now act as its resistance on NIFTY’s way up. That level

is 8460 today as is declining. Having said this, it is also important to note

that the NIFTY is near its pattern support on its Closing Charts and downsides

from current levels remain very limited.

All and all, even if we continue to remain in continuing downtrend, there are

high possibilities of a technical pullback in today’s session or in sessions to

come. It is reiterated to continue to use all downsides to make select stock

specific purchases. Shorts should be avoided as short trap may occur. Overall,

which maintaining a cautious view on the Markets, optimistic outlook is advised

for today.

Milan Vaishnav, CMT

Technical Analyst

(Research Analyst, SEBI Reg.

No. INH000003341)

Member:

Market Technicians Association, (MTA), USA

Canadian Society of Technical Analysts, (CSTA), CANADA

Association of Technical Market Analysts, (ATMA), INDIA

http://milan-vaishnav.blogspot.com

+91-98250-16331

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.