MARKET REPORT February

05, 2014

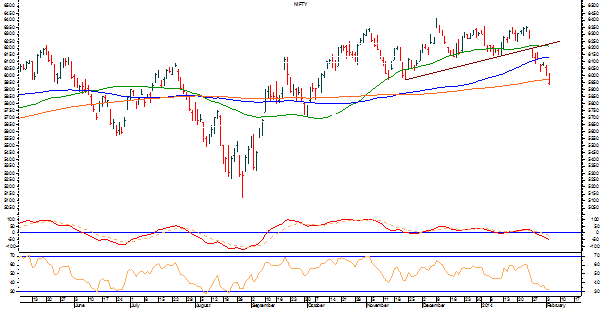

The Markets fared out exactly as analysed in our yesterday’s

edition of Daily Market Trend Guide as it saw a gap down opening following

global weakness and dipped below its 200-DMA intraday. However, this levels

continued to hold as support as Close levels as the Markets recovered during the

day to end the day above 200-DMA. The Markets opened on a gap down and soon

formed its intraday low of 5933.30 in the early minutes of the trade. However,

the Markets attempted to form a upward rising trajectory, though it continued

to trade in a range until afternoon trade. It saw a sharper recovery coming in

the second half of the session wherein the Markets recovered all of its losses.

It even traded in the positive territory as it went on to form the day’s high

of 6017.80 rising over 80-odd points from its day’s low. It finally ended the

day flat at 6000.90, posting a net loss of just 0.90 points or 0.01% forming a

lower top and lower bottom on the Daily High Low Charts.

MARKET TREND FOR TODAY

Today’s analysis

continue to remain on the similar lines like yesterday. Today, we are expected

to see a flat to mildly negative and quiet opening and the Markets are again

likely to hover around its 200-DMA. It is likely that the Markets consolidate a

bit and attempts to find bottom around this levels. The intraday trajectory and

the behaviour vis-à-vis the levels of 200-DMA would continue to remain crucial.

Today, the levels of 6045 and 6080 would as immediate

resistance on the Charts whereas the levels of 5975 and 5930 would act as

support.

The RSI—Relative Strength Index on the Daily Chart is

31.6784 and it has reached its lowest value in last 14-days which is bearish. It

does not show any bullish or bearish divergences. The Daily MACD continues to

trade below its signal line.

On the derivative front, the NIFTY February futures have

added over 1.95 lakh shares or over 1.22% in open interest. This figure clearly

shows that the rise of over 80-odd points that we saw yesterday from the lows

of the day was just not merely on account of short covering. It has seen some fresh buying as well which is

clearly a positive indication.

Having said this, though the Markets are likely to see a

subdued opening, the chances of it maintaining the levels above of 200-dma are

very bright and the Markets are very likely to attempt a trend reversal from

these levels.

All and all, we continue to reiterate the analysis reading

given yesterday. The Markets are attempting hard to find a bottom and reverse

the trend. It is advised to continue / begin making fresh purchases on a very

selective note while maintaining adequate liquidity and protecting profits at

higher levels. Overall, positive outlook with a tinge of caution is advised for

today.

Milan Vaishnav,

Consulting Technical Analyst,

+91-98250-16331

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.